I. Introduction

It is well established that geopolitical risk (GPR) plays a critical role in shaping the dynamics of global economies and international trade. According to Tuathail (1998), GPR represents the uncertainty and global instability resulting from international political dynamics, and its impact extends beyond national borders. Snowberg et al. (2007) generally describe GPR as a measure of political tensions in the economy.

We focus on the mutual relationships between GPRs of G7 (Canada, France, Germany, Italy, Japan, UK, and the US) and BRICS (Brazil, China, India, Russia, and South Africa) countries and on how these GPRs influence commodity futures prices. The transmission mechanism linking geopolitical risk and futures prices represents a rather unexplored field (Mei et al., 2020). On the other hand, Jiao et al. (2023) suggest that changes in commodity prices due to GPR foster two types of speculation: short-term investors can perform some arbitrage, and long-term investors can reduce the overall risk of their portfolios by investing less in affected assets from geopolitics. Recently, Aloui et al. (2023) show that GPR influences several commodity futures prices, while Zheng et al. (2023) finds the same results for China. Moreover, Mitsas et al. (2022) and Jia et al. (2023) document that GPR has a weak effect on the future volatility of corn and some metal futures.

By examining spillovers within GPR and commodity futures, we aim to fill some gaps in the literature. First, we extend the approach of Alam et al. (2022) to a broader list of commodities than just crude oil and gold. Second, in line with Nasir and Morgan (2018), we adopt a time-varying global network analysis as an alternative methodology to the stochastic volatility models often used in previous studies. Finally, our analysis uses a sample ending in March 2024, thus covering a long period relating to the current Russian-Ukrainian conflict.

We find a prevailing state of geopolitical stability from 2010 to 2022, including the period of the COVID-19 pandemic. The Russia-Ukraine conflict is likely to provoke a strong wave of global geopolitical instability, particularly in energy markets, leading the BRICS and the United States (US) to produce spillovers. Among commodities, the energy sector has been the most sensitive to geopolitical shocks from Germany, Russia, France, and Italy.

As demonstrated by Asafo-Adjei et al. (2023), the Russia-Ukraine war has led to greater interconnection between the G7 countries, while Ahmed et al. (2022) show how this conflict has contributed to their economic instability and security. Otherwise, Li et al. (2023) state that the GPR plays a key role in the growing financial and macroeconomic instability of the BRICS, whereas Rumokoy et al. (2023) claim that geopolitical tensions impact commodity markets.

II. Data and Model

Since a recent strand of the literature suggests that national GPRs influence various financial environments (Bossman et al., 2023; Caldara et al., 2024; Elsayed & Helmi, 2021; Sohag et al., 2022), we focus on their impact on commodity futures markets. As in Alam et al. (2022), we conduct our analysis on n=12 country-specific GPR indices (G7 and BRICS) and future prices of the 13 most traded commodities. The GPR data are taken from Caldara and Iacoviello (2022), whereas futures prices are collected from Yahoo Finance. We focus on futures prices because they are suitable for examining market dynamics by providing valuable insights into investor sentiment and future market uncertainty, especially when conflicts have erupted.

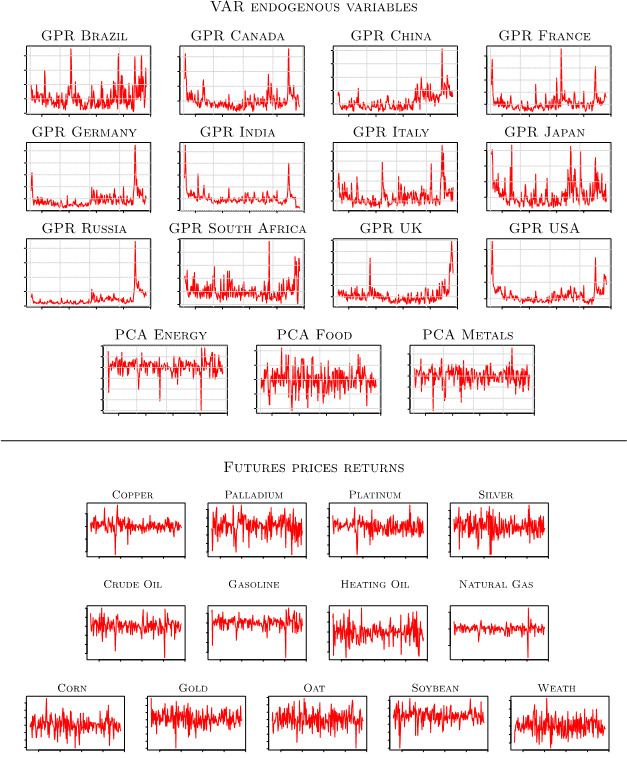

Our analysis is carried out on monthly data from January 2002 to March 2024. We standardized the GPRs to make them comparable. According to the Augmented Dickey-Fuller, Phillips-Perron and KPSS tests, all the variables are stationary at levels. Following Foglia et al. (2023), we conducted a preliminary cluster analysis on 13 futures returns thus obtaining m=3 main categories, namely energy (Gasoline, Heating Oil, Natural Gas, and Crude Oil), metals (Copper, Gold, Palladium, Platinum, and Silver), and food (Corn, Oats, Soybeans, and Wheat). The time series of such categories are obtained by extracting the first principal components (PCAs).[1]

We estimate two separate Time-Varying Parameters VAR (TVPVAR) models: Model A is estimated on country GPRs, whereas Model B considers PCAs and hence it is performed on n+m=15 time series. In both cases, following the Bayesian information criterion, we estimate the TVPVAR (1):

yt=Atyt−1+εt,

where yt is the n-dimensional vector containing the standardized variables, At is the matrix of time-varying coefficients, and εt is a vector of n martingale differences. Since Equation (1) needs to be initialized, we split the overall sample into two subsamples, namely the training and the test sets containing T0 and T1 sample observations, respectively (T0+T1=267). Therefore, we apply our model in three (3) scenarios for the training set starting in January 2002 and ending in January:

-

2010 (T0 =96, T1 =170);

-

2012 (T0 =120, T1 =146);

-

2014 (T0 =144, T1 =122).

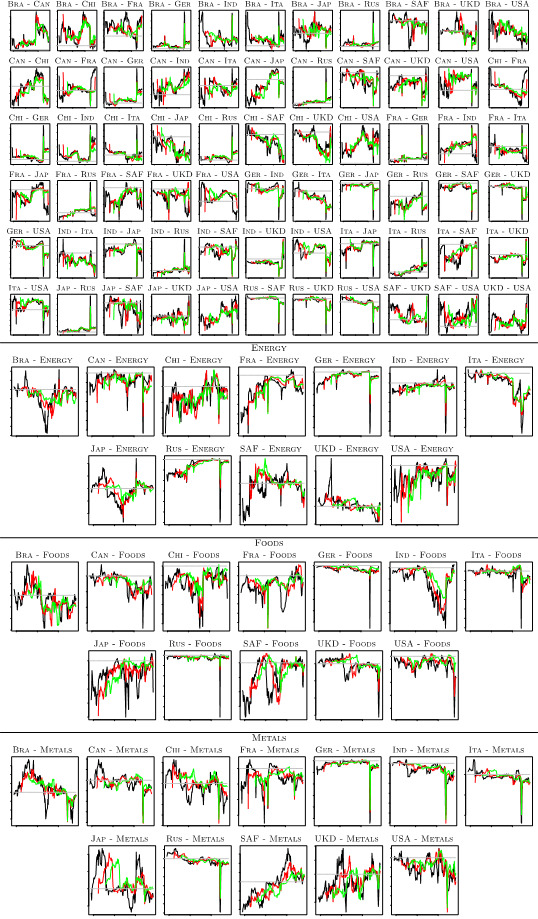

According to Koop and Korobilis (2013), initialization is crucial to ensure the robustness of the results, therefore the choice of different T0 must lead to similar/comparable estimates. Hence, we set T0 = 96 because the estimates are substantially stable when the sample size increases,[2] and we use the scenarios with T0 > 96 to check their robustness. Following Foglia et al. (2023), we further compute directional spillovers.

III. Results

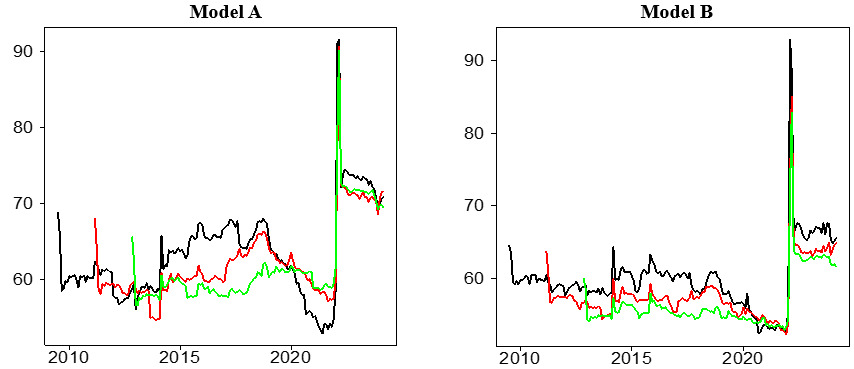

Figure 1 shows the unbiased Total Connectedness Index (TCI, see Chatziantoniou & Gabauer, 2021) as a measure of the market interconnection, while Table A.1 reports the average connectedness results. Over the decade 2010-2022, we found that the average TCI is around 60 in Model A and 55 in Model B with a decreasing trend during the COVID-19 pandemic. These aspects identify a stable geopolitical situation in which governments have adjusted their political and economic objectives, strengthened collaboration, and implemented unified health policies during the pandemic.

The TCI in Figure 1 shows a peak in both models in early 2022, when the Russia-Ukraine conflict erupted. This event generated spillover effects, thus leading to a substantial increase in market interconnectedness. For example, the TCI in Model B raises from 55 to approximately 93 (+69%), highlighting how increased geopolitical uncertainty has led to widespread uncertainty about energy security and greater interconnectedness in energy-related geopolitical risks.

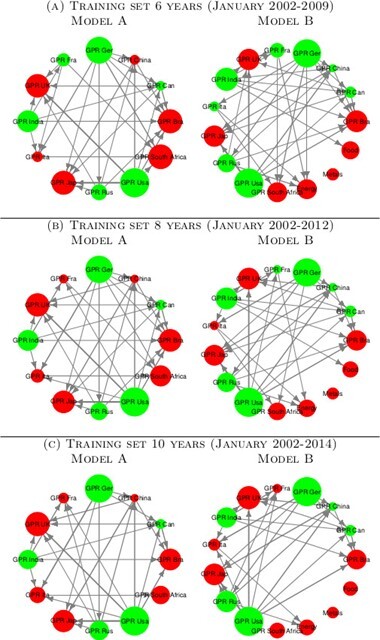

Figure 2 reports the average networks for Models A and B, while Figure A.2 shows the pairwise direction of the time-varying net spillovers among GPRs and from GPR to commodity futures returns. In general, Germany appears as the leading spillover emitter for European countries, while the United States emits GPR spillovers to several countries, including the UK and Russia. Contrary to Alam et al. (2022), who argue that the US receives spillovers from commodity sectors, we found no evidence of any clear link between US GPR dynamics and commodity futures prices, whereas the GPRs of Russia and India influence the prices of energy and food futures, respectively. Our analysis also highlights that the energy market is sensitive to French and Italian GPRs. This is consistent with Dai et al. (2022), as these countries are net exporters and importers, respectively. In contrast, metal futures prices are not affected by country-specific geopolitical shocks. While Canada and China can be seen as stabilizer countries as they emit and receive various spillovers, Japan is the most relevant recipient as it is perceived globally as the least risky country geopolitically. Our results suggest some economic/financial implications. First, any geopolitical shock within the US, Germany, India, or Russia can have repercussions on international financial markets. Second, a global geopolitical interdependence emerges, as the G7 appears to transmit spillovers to the BRICS and vice versa. Finally, our analysis confirms that Russia transmits spillovers abroad and to the energy market due to its dual role as an energy producer and a major player in the military conflict against Ukraine.

IV. Conclusions

We analysed how GPR propagates between G7 and BRICS countries and how it influences commodity futures prices. We found geopolitical stability from 2010 to early 2022, but a global GPR increase emerged when the Russia-Ukraine conflict erupted. This has generated spillovers between nations. We also revealed a strong interconnection between all examined countries, and the GPRs of the US, Germany, India, and Russia appear to be the key drivers. As expected, the energy sector is the most influenced.

Our results suggest that political instability can reduce energy supply, especially for net importing countries. As evident in the aftermath of Russia’s invasion of Ukraine, sudden supply restrictions or changes in trade policies can increase energy prices. Second, policymakers and/or investors need consider country-specific GPRs, as they could affect the energy sector. Third, GPRs can be relevant factors for designing coordinated foreign policy strategies, thus promoting global economic stability.